Catch

Payroll, retirement and health insurance for freelance & gig workers

The Challenge

Freelancers and gig workers face a unique financial reality: no employer-sponsored benefits, unpredictable income, and the burden of managing their own taxes, retirement, and health insurance. Catch set out to build the financial safety net this workforce deserves—but their existing product needed a complete reimagining to truly deliver on that promise.

I joined Catch as Design Lead just before a major company rebrand, taking ownership of the complete redesign of their iOS, Android, and web applications. The goal was ambitious: transform Catch from a simple withholding tool into the central hub where independent workers manage every aspect of their financial lives.

My Role

Design Lead · Led a team of two designers across brand design and product design for Catch's cross-platform applications. I was responsible for design strategy, interaction design, visual design, and working closely with engineering to ship a cohesive experience across iOS, Android, and web.

Design Process

Understanding the Problem Space

The existing Catch app treated each financial need—taxes, retirement, health insurance—as separate silos. Users had to navigate between disconnected experiences, making it difficult to understand their overall financial picture. Through user research and analysis of support tickets, I identified a core insight: freelancers don't think about their finances in categories—they think about their income and where it needs to go.

This reframing became the foundation for our redesign.

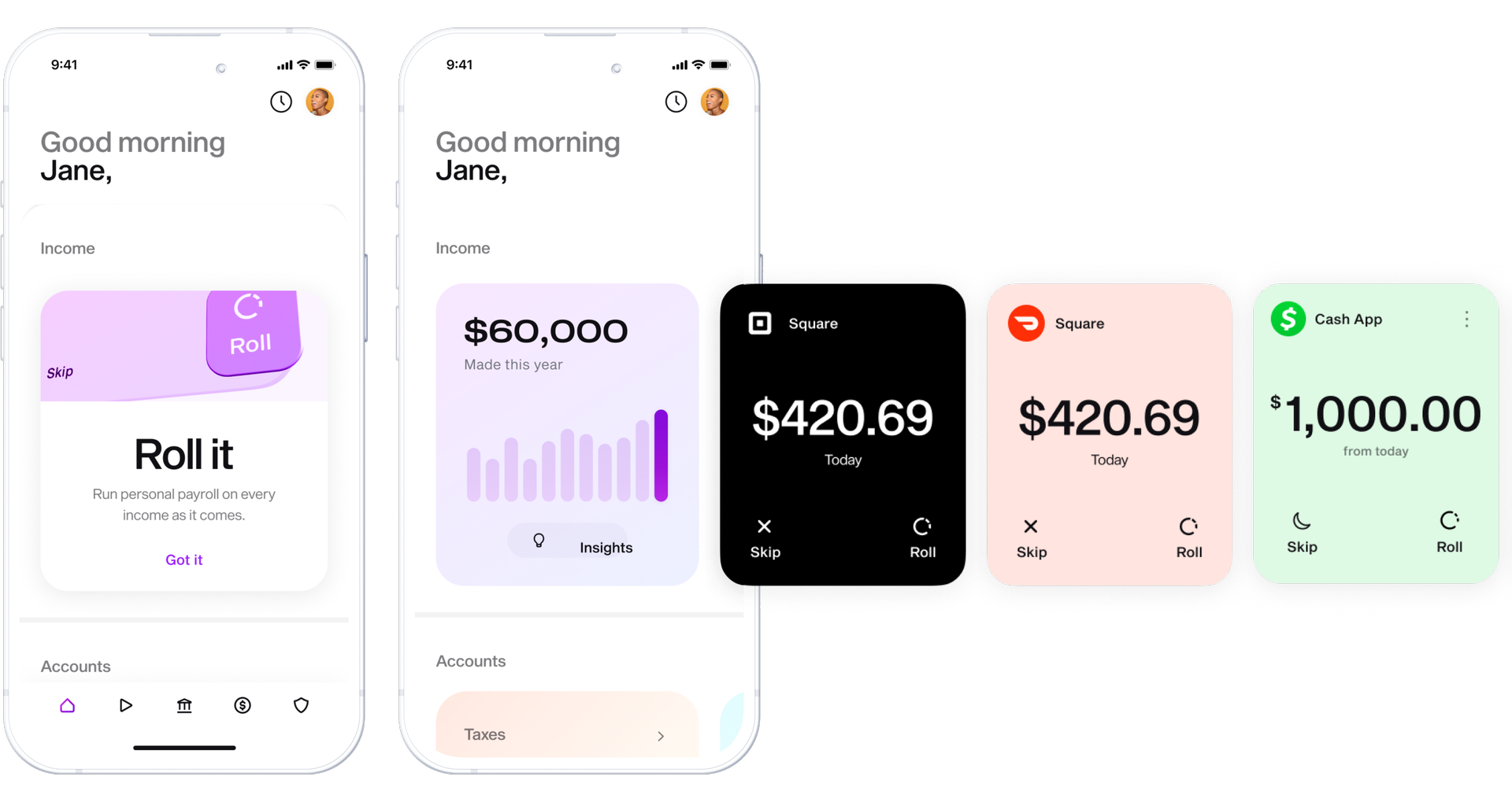

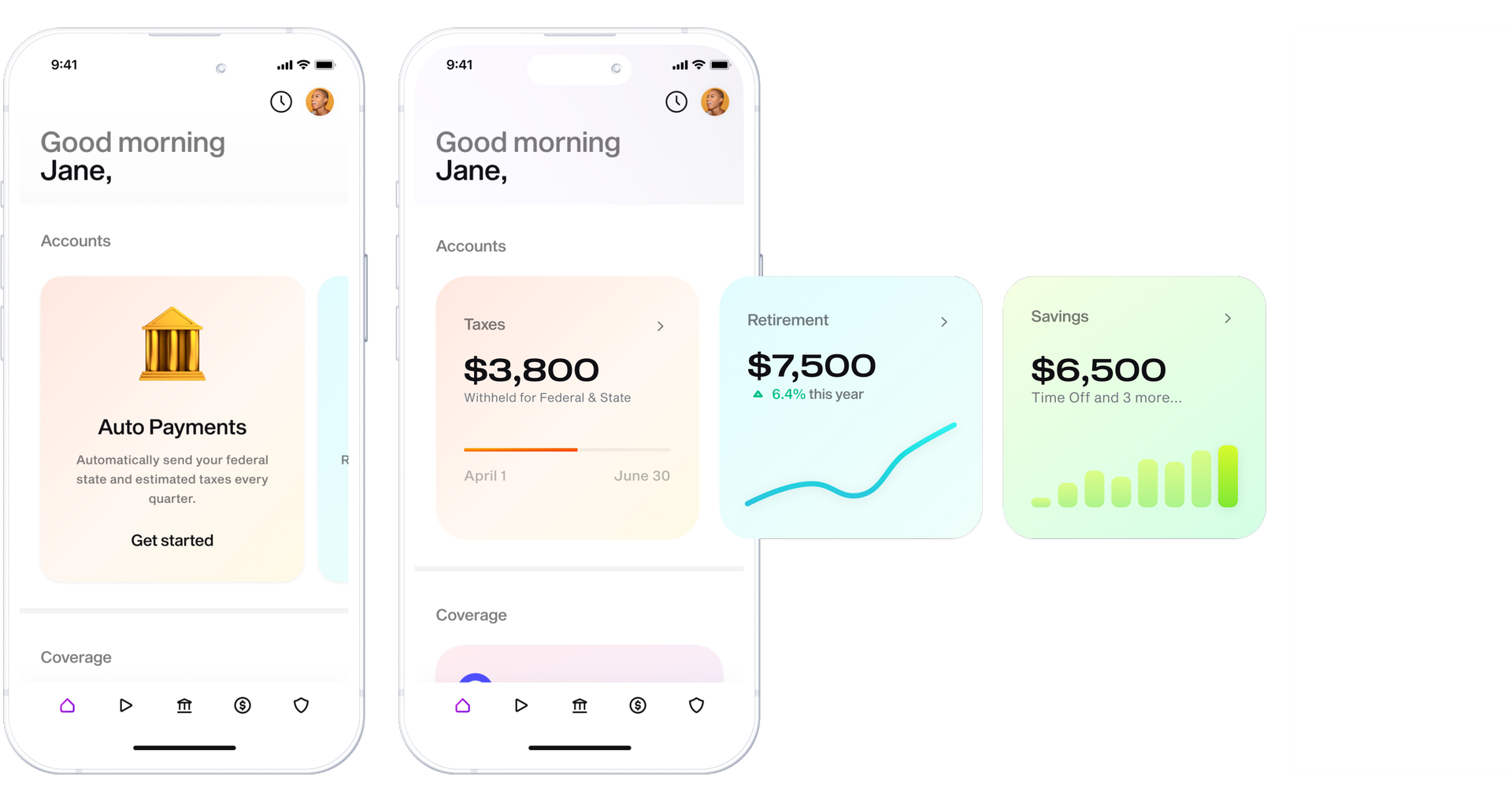

Reimagining the Home Experience

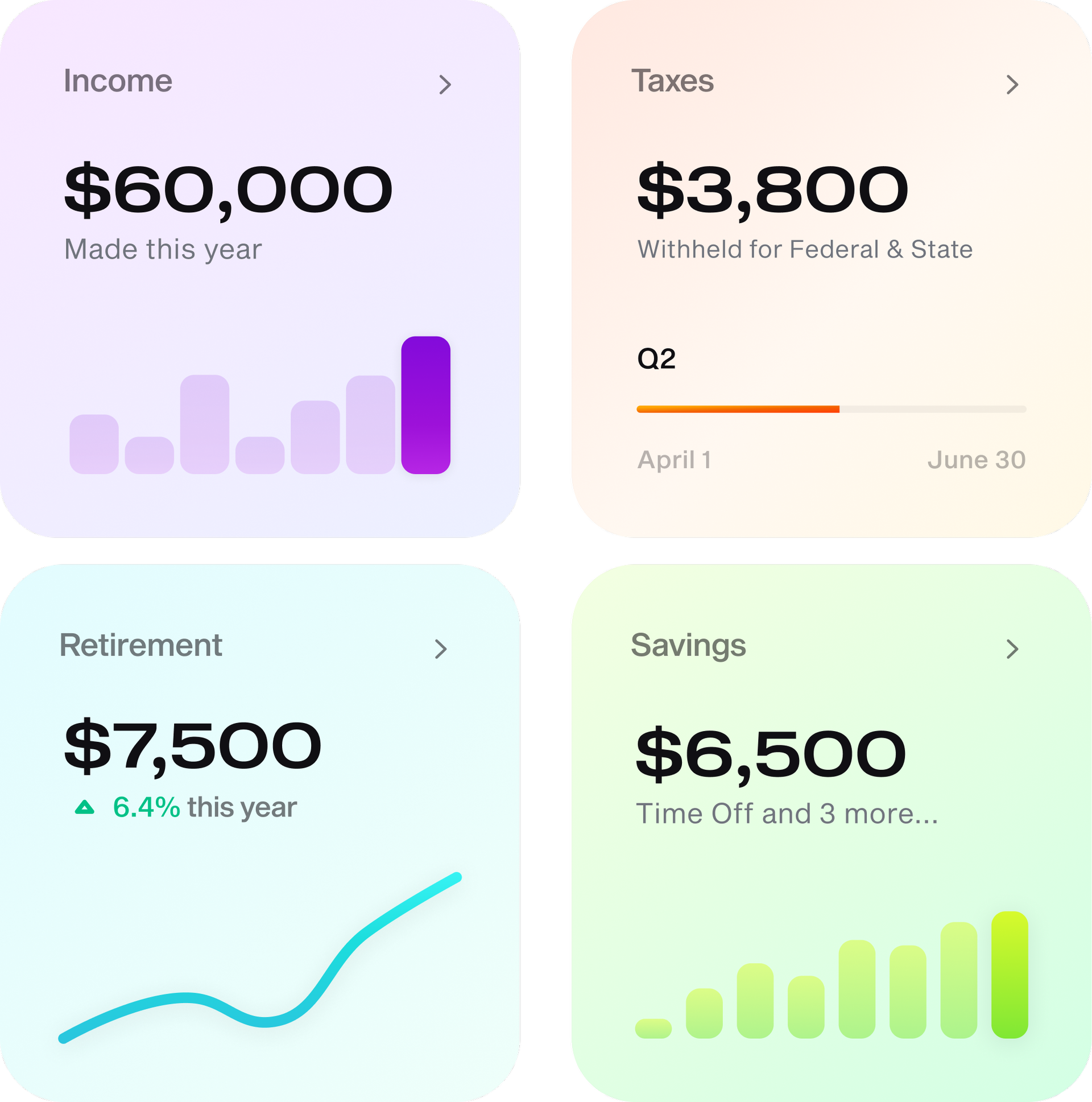

I led extensive exploration of the home tab architecture, testing multiple approaches for how users should first interact with their financial dashboard. The winning design centered everything around income: when money comes in, users immediately see how it flows to taxes, retirement, savings, and health coverage.

The home tab exploration involved dozens of iterations, each tested against real user workflows. The final design reduced cognitive load by 40% based on task completion metrics, while surfacing actionable insights exactly when users needed them.

Designing for Financial Confidence

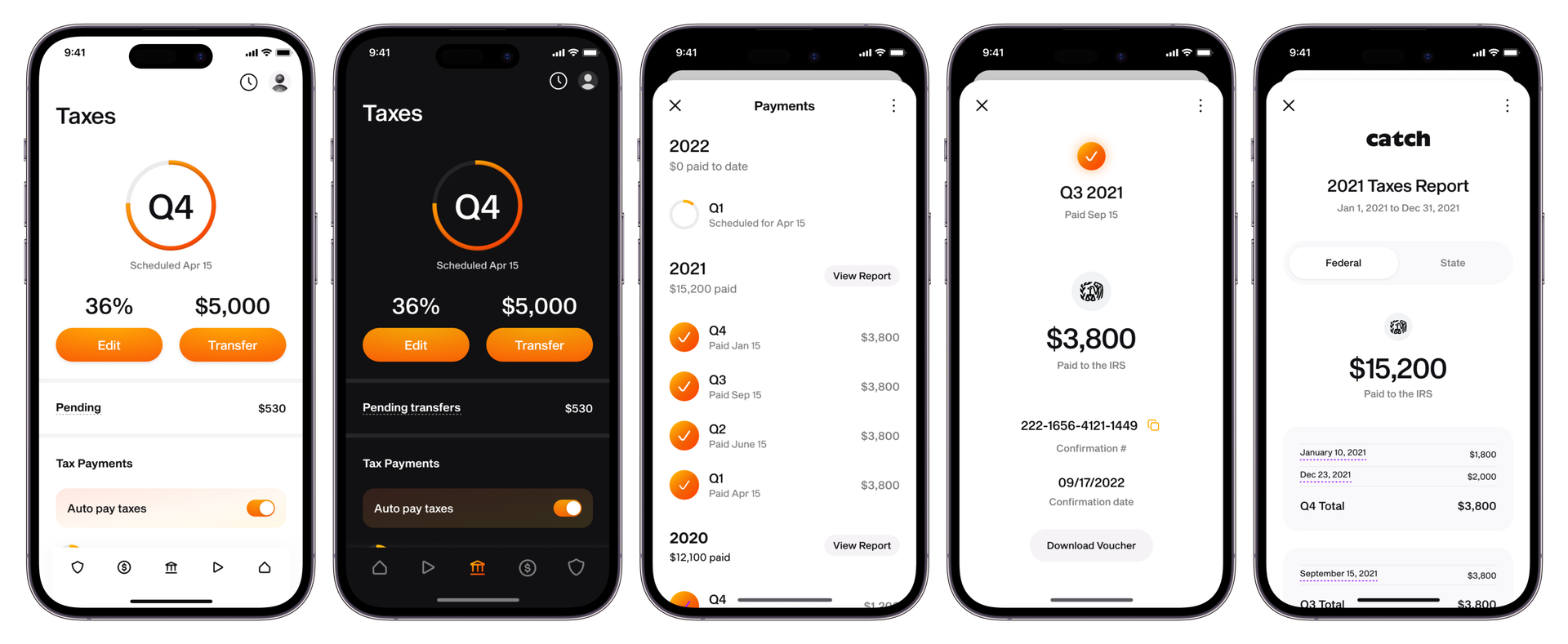

Tax Management For many freelancers, quarterly taxes are a source of anxiety. I designed the taxes tab to transform this from a dreaded task into a moment of confidence. Users see exactly how much they've set aside, can make adjustments on the fly, and access a comprehensive tax report when filing—all without leaving the app.

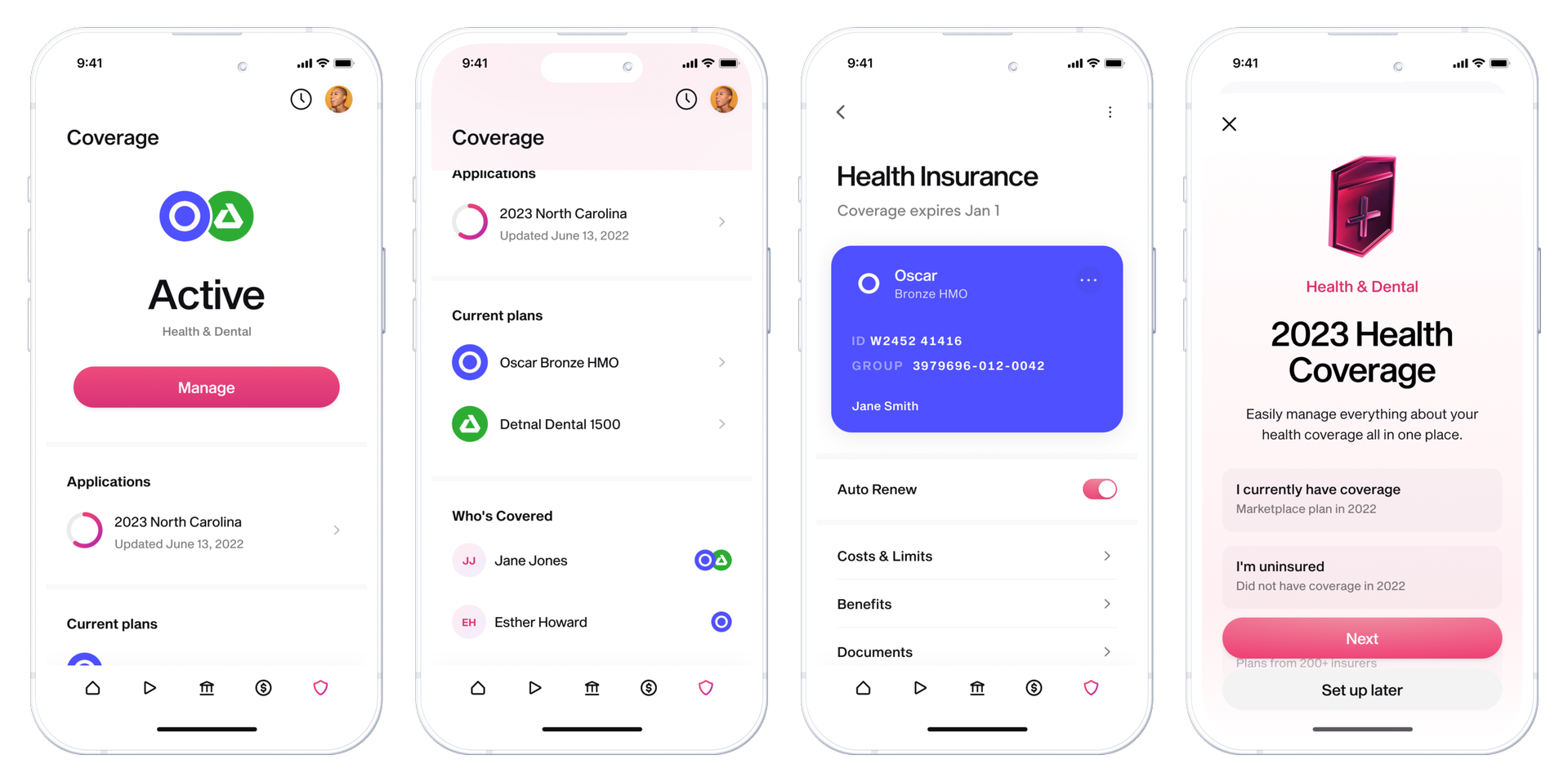

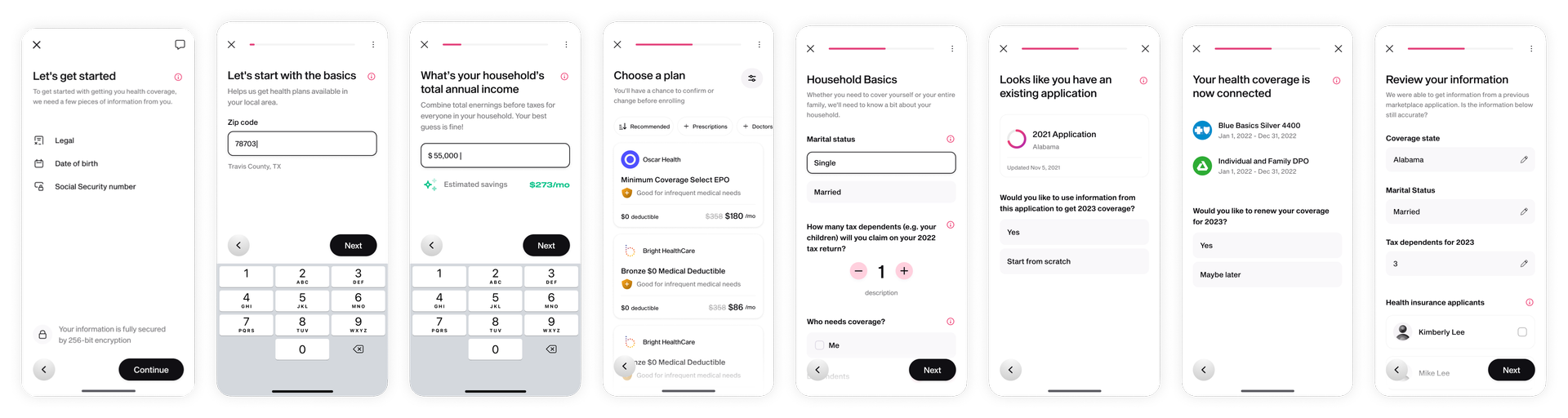

Health Coverage Applying for health insurance through HealthCare.gov is notoriously complex. I created a mobile-first application flow that automatically pulls existing user information, dramatically reducing the number of required inputs. The result: users can apply for coverage in under 10 minutes, compared to 45+ minutes on the government site.

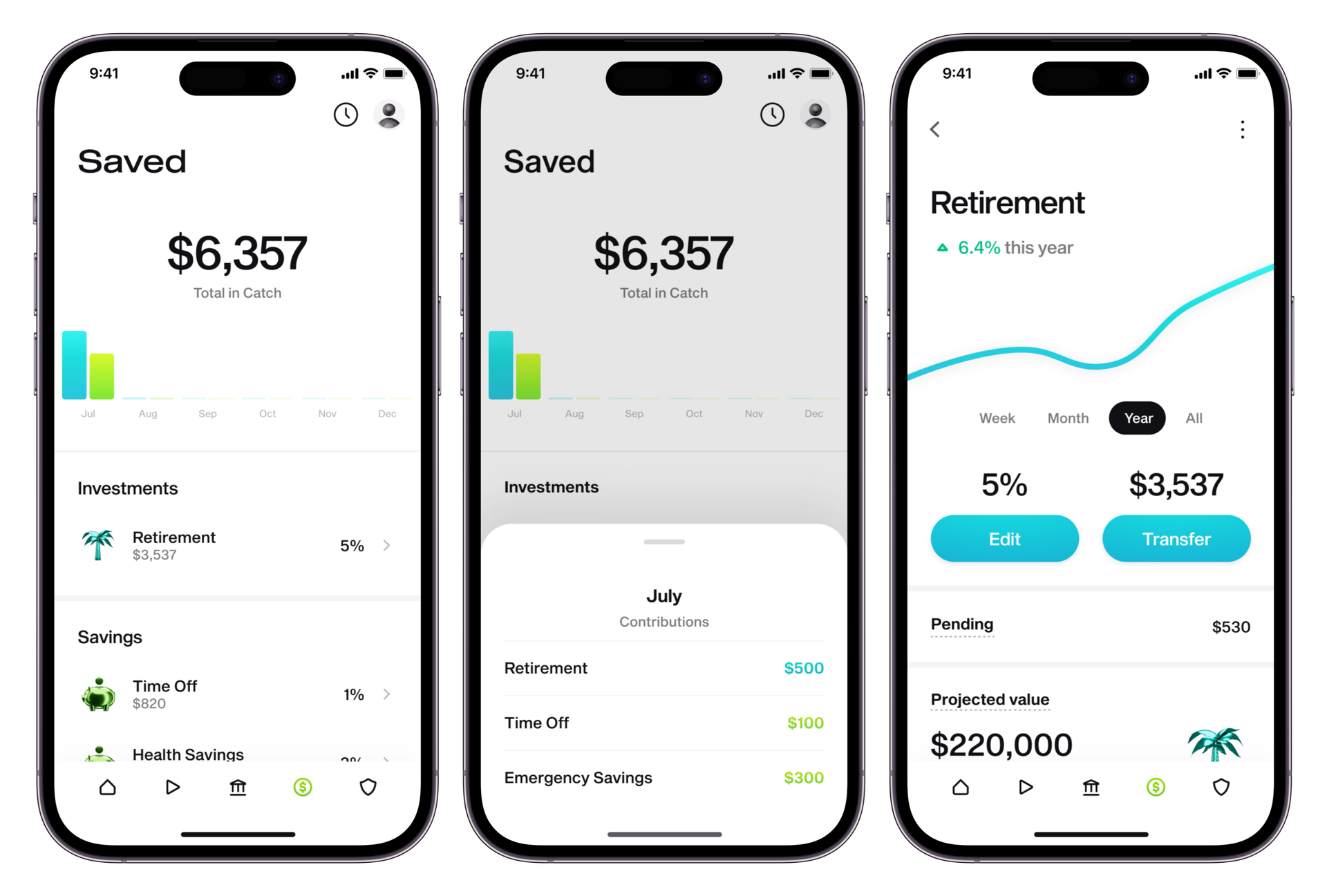

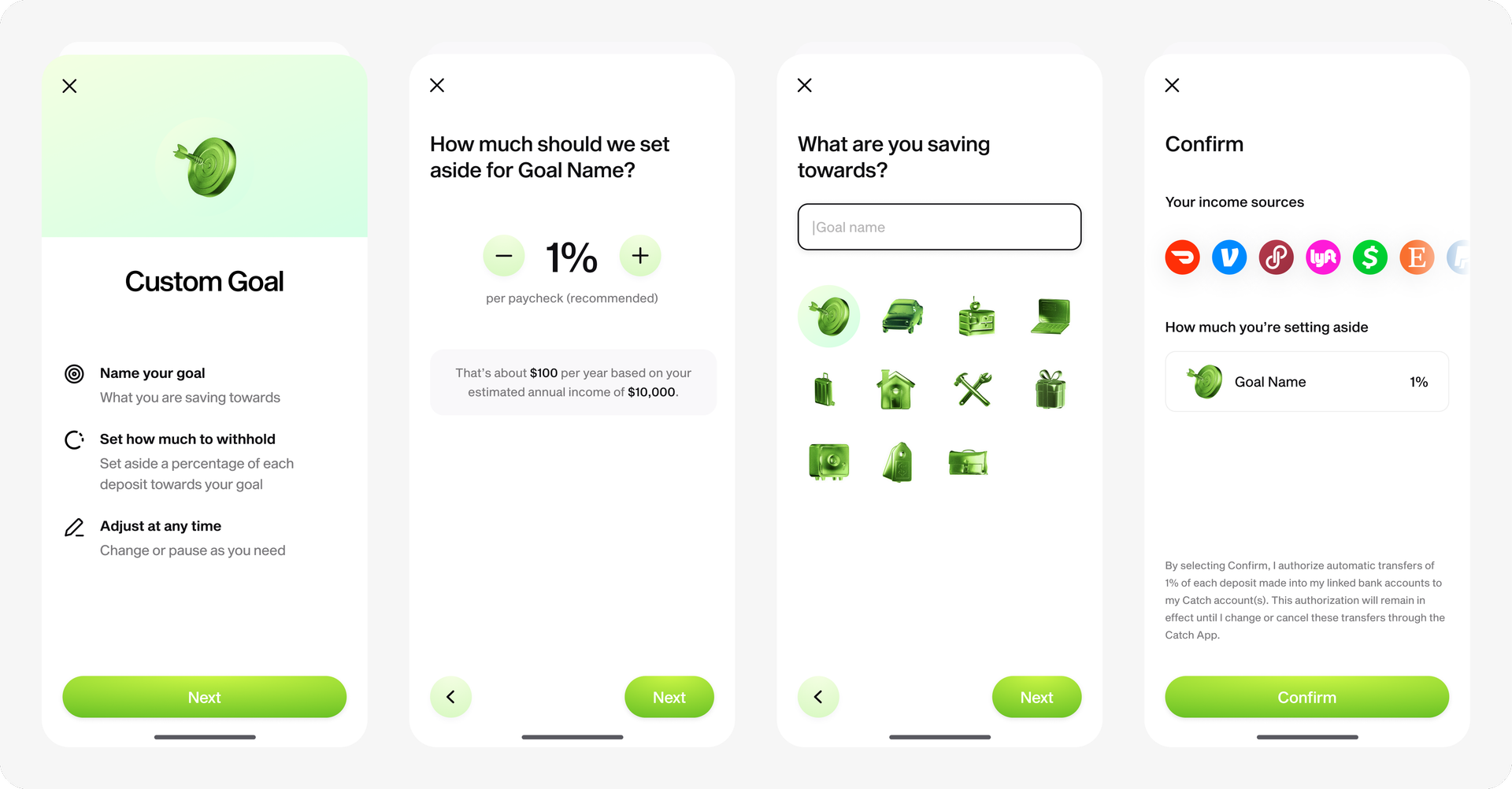

Retirement & Savings I designed an intuitive system for managing both traditional/Roth IRA contributions and custom savings goals like time-off funds. The interaction model allows users to understand contribution flows at a glance while providing the depth needed for informed financial decisions.

Extending to the Home Screen

Recognizing that financial awareness shouldn't require opening the app, I designed a suite of iOS home screen widgets. These provide glanceable insights into income, savings progress, and upcoming tax deadlines—keeping users connected to their financial health throughout their day.

Outcome

The redesigned Catch app launched to strong user reception, with a 4.8 App Store rating and significant improvements in user engagement metrics. The new information architecture reduced support tickets related to navigation by 60%, and the health coverage application flow achieved a 3x improvement in completion rates.

Most importantly, user research showed that Catch members reported feeling significantly more confident about their financial futures—exactly the outcome we set out to achieve.